In the fast-paced world of Forex trading, having the right tools is essential. One of the most popular platforms among traders is trading forex in tradingview Trading Platform HK, known for its robust features and user-friendly interface. Whether you are a beginner or an experienced trader, understanding how to utilize TradingView can significantly enhance your trading experience. This article will provide insights into how to effectively trade Forex using TradingView, focusing on its features, tools, and strategies that can help you succeed in the Forex market.

What is TradingView?

TradingView is a cloud-based charting platform that caters to traders of all levels. It provides real-time data and offers a wide range of charting tools and technical analysis features. With its collaborative functionalities, it allows traders to share ideas and strategies, fostering a community of learning and support. The platform is especially popular for Forex trading, as it supports multiple currency pairs and provides in-depth analyses that traders can utilize.

Getting Started with TradingView

Before diving into Forex trading using TradingView, it’s crucial to set up your account. Here’s how you can get started:

- Create an Account: Visit the TradingView website and create a free account. There are also premium subscription plans that offer advanced features.

- Explore the Interface: Familiarize yourself with the layout, including the charting area, tools, and social features.

- Select Forex Market: Use the search bar to find the currency pairs you are interested in trading.

Understanding the Charting Tools

One of the key features of TradingView is its advanced charting tools. Here are some essential tools that every Forex trader should know:

1. Chart Types

TradingView offers several chart types, including line charts, candlestick charts, and bar charts. The candlestick chart is particularly beneficial for Forex traders as it provides a visual representation of price action, allowing traders to make informed decisions based on trends and patterns.

2. Technical Indicators

Technical indicators are essential for analyzing price movements. TradingView provides a wide array of indicators, including moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands. You can customize these indicators to fit your trading style.

3. Drawing Tools

Utilizing drawing tools can help traders identify support and resistance levels, trend lines, and other key market structures. TradingView provides various drawing tools, such as trend lines, Fibonacci retracements, and horizontal lines, which can be vital for technical analysis.

Developing Your Trading Strategy

Having a solid trading strategy is crucial for success in Forex markets. Here are steps to develop an effective trading strategy using TradingView:

- Define Your Goals: Determine what you aim to achieve with your trading. Are you looking for short-term gains or long-term investments?

- Conduct Market Analysis: Use TradingView’s tools to analyze market trends and evaluate different currency pairs. Look for patterns and signals that indicate potential trades.

- Backtest Your Strategy: Before committing real money, backtest your strategy using historical data available on TradingView. This can help you understand the potential profitability of your strategy.

- Implement Risk Management: Decide on the amount of risk you are willing to take for each trade and employ risk management techniques, such as setting stop-loss orders.

Utilizing Social Features for Trade Ideas

One of the unique aspects of TradingView is its social features. Traders can share ideas, strategies, and analyses, which can be immensely beneficial for both new and experienced traders. Here’s how you can leverage these features:

- Follow Experienced Traders: Identify and follow top traders in your preferred markets. You can gain insights from their analyses and see how they approach different trades.

- Participate in Discussions: Engage in forums and discussions related to Forex trading. Asking questions and sharing your thoughts can provide different perspectives.

- Publish Your Ideas: Once you gain confidence, consider publishing your trading ideas. This can help you build a following and also receive feedback from other traders.

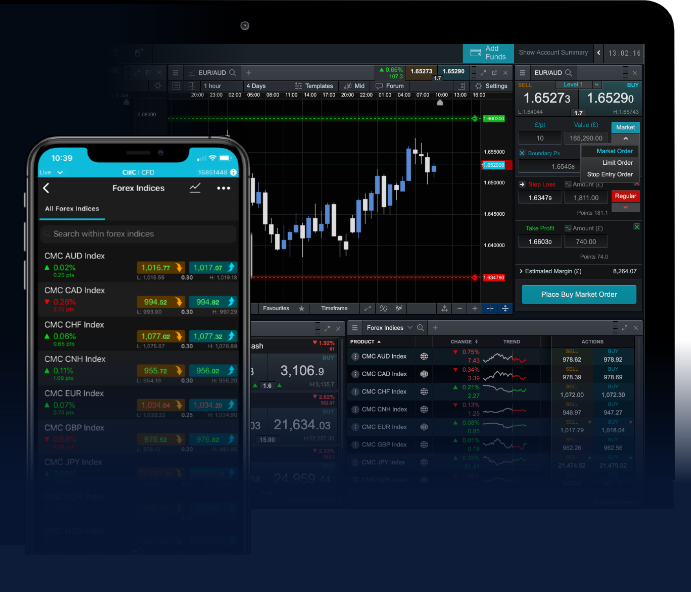

Mobile Trading with TradingView

In today’s fast-moving markets, being able to trade on the go is paramount. TradingView offers a robust mobile application that allows traders to access their accounts and charts from anywhere. Here are some features of the mobile app:

- Real-Time Alerts: Set price alerts that notify you of market movements, helping you stay informed and make timely trading decisions.

- Access to Charts: The mobile app has the same powerful charting features as the desktop version, allowing you to analyze markets on the go.

- Community Interaction: Engage with the TradingView community directly from your mobile device, giving you the opportunity to learn and share insights while away from your computer.

Conclusion

Trading Forex in TradingView can truly elevate a trader’s experience. With its multitude of features, tools, and social networking capabilities, traders are better equipped to analyze the markets and execute trades effectively. Whether you are a beginner just getting started or an experienced trader looking for advanced insights, TradingView provides a comprehensive platform that caters to all your Forex trading needs. Take the time to explore its features, develop your strategy, and engage with the community to maximize your trading success.