Forex Trading for Beginners: A Comprehensive Guide

Forex trading, commonly referred to as FX trading, is the act of buying and selling currencies on the foreign exchange market with the aim of making a profit. For beginners, stepping into the world of Forex can be both daunting and exciting. Understanding the basics, developing effective strategies, and cultivating healthy trading habits are essential steps for any novice trader. In this article, we’ll explore what Forex trading entails, the key concepts to grasp, and practical tips to enhance your trading journey. For more detailed resources, you can check out forex trading beginners https://trading-bd.com/.

What is Forex Trading?

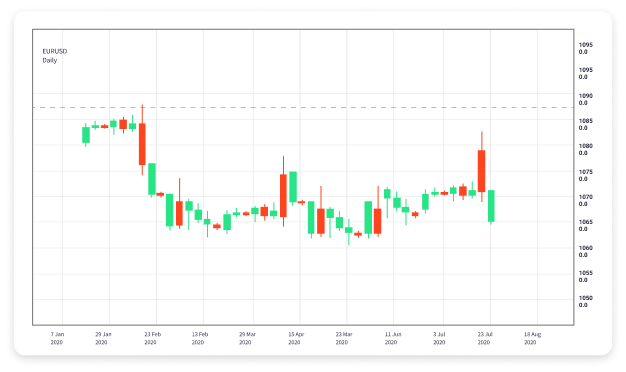

Forex trading involves the exchange of one currency for another in pairs. Each currency pair has a base currency and a quote currency. For example, in the pair EUR/USD, the Euro (EUR) is the base currency, and the US Dollar (USD) is the quote currency. The price of this pair indicates how much of the quote currency you need to purchase one unit of the base currency. Forex trading is conducted over-the-counter (OTC), meaning that it occurs directly between parties, usually via electronic trading networks.

Understanding Currency Pairs

Currency pairs are classified into three categories: major, minor, and exotic. Major pairs consist of the most frequently traded currencies, such as EUR/USD, GBP/USD, and USD/JPY. Minor pairs involve currencies that are less commonly traded, like AUD/NZD or GBP/CAD. Exotic pairs consist of a major currency paired with a currency from a developing economy, such as USD/THB (Thai Baht) or EUR/TRY (Turkish Lira). Understanding the dynamics of these pairs is crucial for successful trading.

Key Concepts in Forex Trading

1. Pips and Lots

In Forex trading, the smallest price movement is measured in pips (percentage in point), which indicates the change in value between two currencies. A ‘lot’ refers to the quantity of currency units you are trading. Standard lots comprise 100,000 units, mini lots consist of 10,000 units, and micro lots are 1,000 units. Understanding how these concepts affect your risk management and profit potential is crucial.

2. Leverage

Leverage allows traders to control a larger position size with a smaller amount of capital. For instance, a leverage ratio of 100:1 means that for every dollar in your trading account, you can control up to 100 dollars in the market. While leverage can amplify profits, it also increases the risk of significant losses, making it essential to use it wisely.

3. Spreads

The spread represents the difference between the bid price and the ask price of a currency pair. This cost can impact your profitability, especially if you are making multiple trades. Understanding how spreads work and their impact on your trades is crucial for effectual trading.

Forex Trading Strategies for Beginners

1. Day Trading

Day trading involves opening and closing trades within the same day to capitalize on short-term price movements. Traders often use technical analysis and chart patterns to identify potential trades. It requires a good understanding of market trends and is suited for those who can dedicate significant time to monitoring the markets.

2. Swing Trading

Swing trading involves holding onto a position for several days or weeks to profit from expected price movements. This strategy allows traders to take advantage of price swings in the market while avoiding the need for constant monitoring.

3. Scalping

Scalping is a fast-paced strategy that aims to take small profits from many trades throughout the day. Scalpers often execute dozens or even hundreds of trades per day, relying on short-term price fluctuations to make a profit. This strategy requires quick decision-making and execution skills.

Risk Management in Forex Trading

Managing risk is critical in Forex trading. Here are some essential risk management techniques:

- Set Stop-Loss Orders: A stop-loss order automatically closes your trade at a predetermined price to limit losses.

- Position Sizing: Only risk a small percentage of your trading capital on a single trade to protect your account from significant losses.

- Diversification: Avoid putting all your capital in one trade or currency pair. Diversify your investments across various pairs to spread risk.

Maintaining Discipline and Patience

Successful Forex trading requires discipline and patience. It’s important to stick to your trading plan, avoid emotional trading decisions, and not chase losses. Regularly reviewing your trades to learn from mistakes can significantly improve your trading skills over time.

Tools for Forex Traders

Utilizing the right tools can enhance your trading efficiency. Consider the following:

- Trading Platforms: Platforms like MetaTrader 4, MetaTrader 5, and others provide tools for charting, analysis, and trade execution.

- Forex Calendars: Economic calendars keep you informed about upcoming economic events that can impact currency prices.

- Technical Analysis Tools: Indicators and chart patterns help traders to analyze price movements and make informed decisions.

Conclusion

Forex trading offers ample opportunities for profit, but it requires a solid understanding of market dynamics, effective strategies, and the discipline to manage risks. By educating yourself, practicing with demo accounts, and staying updated with market trends, you can transition from a beginner to a proficient trader. Remember, trading is a marathon, not a sprint; patient, informed decisions lead to sustainable success in the long run. Equip yourself with the right knowledge, tools, and mindset, and embark on your Forex trading journey today!